Under the SEBI (Mutual Funds) Regulations, 1996, mutual funds are allowed to charge operating expenses for managing a mutual fund scheme. These expenses include sales and marketing, administrative expenses, transaction costs, investment management fees, registrar fees, custodian fees, and audit fees. Collectively, these expenses are known as the Total Expense Ratio (TER).

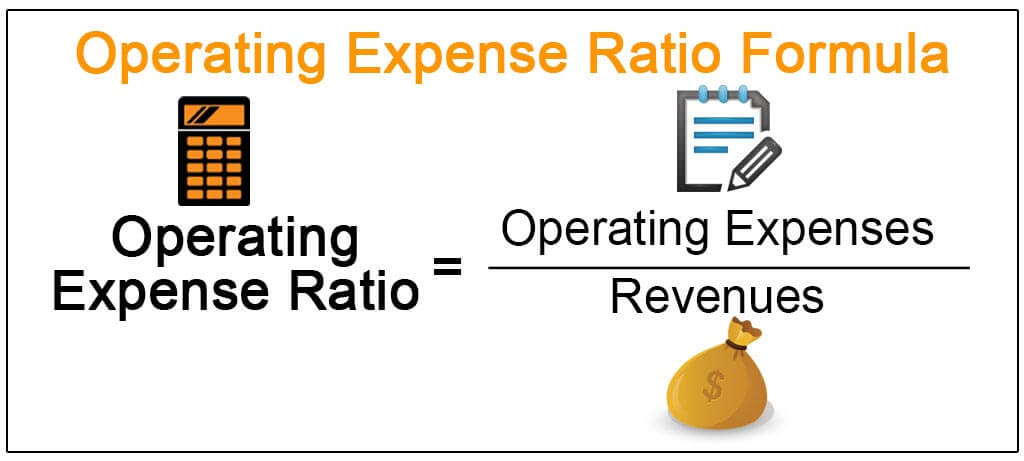

The TER is calculated as a percentage of the scheme's average Net Asset Value (NAV). The daily NAV of a mutual fund is disclosed after deducting the expenses. In India, the expense ratio is fungible, which means that there is no limit on any particular type of expense as long as the total expense ratio is within the prescribed limit. The regulatory limits of TER that can be charged to the fund by a Mutual Fund Asset Management Company (AMC) are specified under Regulation 52 of SEBI Mutual Fund Regulations.